Automatic Enrolment Retirement Savings Bill 2024

Auto-enrolment in retirement savings is expected to be introduced in January 2025 following the publication earlier this month of the Automatic Enrolment Retirement Savings Bill 2024.

Key elements of the proposed legislation that need to be considered by Employers now include:

Scope: Employees will be automatically enrolled in the system if they are:

- Between the ages of 23 and 60,

- Not already a member of a qualifying pension plan, and

- In receipt of total gross pay in all employments of at least €20,000 per annum

National Auto-Enrolment Retirement Savings Authority

The Bill provides for the establishment of this Authority to facilitate the enrolment of qualifying employees, collection of contributions, and establishment and maintenance of retirement savings accounts. The AE Authority will be responsible for the investment of contributions with investment management providers and facilitating the payment of retirement savings. It will have a range of inspection and enforcement powers, including the power to issue compliance and fixed-penalty notices.

Contributions: The Bill proposes three sources of contribution, based on a percentage of an employee’s gross pay, as follows:

| Source | Years 1-3 | Years 4-6 | Years 7-9 | Years 10+ |

| Participant | 1.5% | 3% | 4.5% | 6% |

| Employer | 1.5% | 3% | 4.5% | 6% |

| State | 0.5% | 1% | 1.5% | 2% |

Contributions will be calculated based on gross pay of up to a maximum of €80,000 per annum.

Where employees fall within the scope of the AE system, the AE Authority will notify their employers via a payroll notification of contributions payable to the AE system. Upon receipt of the Payroll Notification employers must:

- calculate, deduct, and pay employee contributions to the AE Authority in respect of the employees covered by the Payroll Notification; and

- calculate and pay corresponding employer contributions to the AE Authority.

Opt-Out / Opt-In

- Employees will have a limited right to opt-out of the AE system. Employees may opt-out during months seven and eight after having been enrolled or re-enrolled. Where employees opt-out they are entitled to a refund of their own contributions.

- The AE Bill does not provide for a refund of employer contributions.

Employer Take Aways

- Identify employees that are within the scope Auto-Enrolment

- Assess if your existing pension Scheme or PRSA can be re-designed to capture all relevant employees OR whether you wish to proceed to compliance via a ‘Dual Scheme’ approach.

- What are the administrative costs associated with each approach

- Are there any Employee Relations issues arising where the operation of a dual scheme will involve different rates of contributions with associated different benefits.

Employers who breach employment law subject to on the spot fines

Employers should pay close attention to the new and amended ‘on the spot’ fines introduced under The Workplace Relations Act 2015 (Fixed Payment Notice) Regulations 2023. These regulations permit Workplace Relations Commission (WRC) inspectors to issue immediate fines for specific employment law offences. While these fines might seem small individually, they can accumulate rapidly for Employers committing multiple infractions across various Employees.

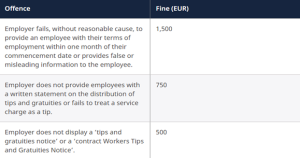

The new fines that the WRC can levy under this legislation are:

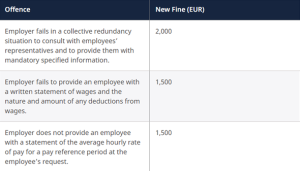

Existing amended fines include:

The Process

The Regulations prescribe the form of fixed payment notices in lieu of prosecution. This form is issued by an inspector of the WRC on the basis of an allegation that an employer has committed one of the offences mentioned above.

The form requires the identification of the legal basis for the offence, the date and details of the offence and the grounds upon which the inspector is satisfied that the offence has occurred, as well as the fixed amount to be paid.

Fined employers will have 42 days to pay the fine which can only be paid by electronic fund transfer. While an employer is not obliged to make the payment, if they do not, then prosecution may follow. However, no prosecution will occur during the 42-day period.

If an employer fails to pay a fine within 42 days, the WRC’s internal legal affairs committee may initiate criminal prosecution, with a potential summary conviction fine of €2,500 for each offence.

Adare Trusted People Partners can Help

If your Organisation requires assistance in understanding and adhering to the updated fine structures under The Workplace Relations Act 2015 (Fixed Payment Notice) Regulations 2023, Adare Trusted People Partners can support you.

Our team of Employment Law and Human Resource experts can be your HR partners and guide you through compliance, ensuring your business knows its obligations; staying protected and informed. Reach out to us at (01) 561 3594 or info@adarehrm.ie for support tailored to your needs. Learn more about our services at www.adarehrm.ie.