In March 2022 the Government announced a significant step forward in addressing the issues faced by an aging population and the need for sustainable retirement solutions by implementing Auto-Enrolment pension schemes. The Bill cited as the Automatic Enrolment Retirement Savings System Bill 2022 is scheduled to go live in the first quarter of 2024. The concept behind this is to ensure that more people have access to retirement savings and financial security in their golden years and represents a pivotal development for Ireland’s retirement planning landscape.

However, with this fundamental change comes several implications for the Employer.

Understanding Auto-Enrolment?

Auto-enrolment is a policy mechanism that encourages Employees to save for retirement by automatically enrolling them in a workplace pension scheme.

The primary objective is to overcome behavioural barriers that prevent individuals from saving adequately for their retirement. To date there are approximately 750,000 private sector Employees who do not have a private pension plan, leaving the State pension as their only primary source of retirement income. This is not sustainable as Ireland’s state pension system is already under strain as a growing population nearing retirement age lives longer lives.

To combat Employees’ reluctance to enrol in pension plans, possibly due to inertia or the fact that their Employer does not provide its own pension plan, the Government has made it essential for all companies to contribute to a worker’s pension, which will also be co-funded by the state.

The premise is simple: anyone between the ages of 23 and 60, and who is earning over €20,000 a year will be automatically enrolled, or opted into the pension scheme when they commence a new job unless they actively opt-out or have their own pension or access to an occupational pension.

An Employee will have the option to opt-out or suspend contributions after six months, however, if still in Employment will be re-enrolled after two years. Once re-enrolled the Employee will again have the option to opt out after six months, but clearly the objective is to get Employees to remain enrolled.

Employer’s Current Pension Framework

Employers should seek professional advice and review any current pension scheme. Owners and senior management should consider if they want to encourage participation in an existing plan or whether Auto-Enrolment is a better solution for their Company and Employees in the future.

Existing schemes may need to be amended (which may require trustee approval) to ensure that appropriate rules for the Auto-Enrolment exemption apply once the system goes live. Any such changes must be considered and executed prior to the Auto-Enrolment System’s implementation.

From the Employee’s perspective, anyone that has already enrolled in an occupational pension scheme or equivalent personal pension scheme will not be automatically enrolled in the new system.

Operating Standards for Auto-Enrolment

Commercial pension providers will have the opportunity to participate in the Auto-Enrolment system through separate tenders for investment management, administration, and fund accounting services.

The Companies chosen to provide investment management services will be referred to as “Registered Providers.” There shall be no direct interaction or relationship between the Registered Providers and the Employees. Their sole customer will be the Central Processing Authority.

The Central Processing Authority (CPA), an independent organisation, will be established to monitor and operate the plan, as well as to set standards for the automatic enrolment retirement savings system on behalf of participating members and Employers.

How does the Auto-Enrolment scheme affect Employers?

Currently, Ireland is the only OECD country that does not use an Automatic Enrolment (AE) or comparable scheme to encourage pension savings. The proposed new approach is intended to simplify pension options for Employees while also making it easier for Employers to offer a workplace pension.

- All of your Employees meeting the eligibility criteria, who do not already have a pension scheme will be enrolled in the Auto-Enrolment pension.

- You will need to ensure that your payroll can take instruction for enrolment and calculate and pay Employee and Employer contributions to the Central Processing Authority.

- You will be required to match members’ contributions up to an eventual maximum of 6% subject to an earnings threshold of €80,000.

- Employer contributions will be deductible for corporation tax purposes.

- If you fail to meet your Auto-Enrolment obligations as an Employer, you will be subject to penalties and possibly to prosecution.

How much it will cost the Employer?

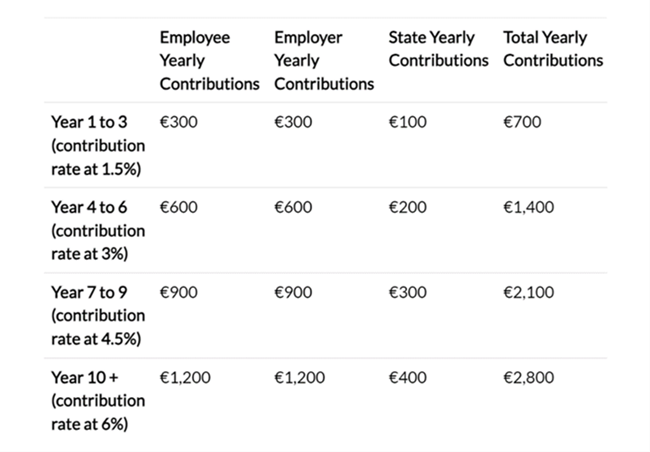

- Employer contributions will start at 1.5% of gross pay.

- In year 4 they will increase to 3%.

- In year 7 they will increase to 4.5%.

- In year 10 they will increase to the maximum rate of 6%.

- Contributions will be fixed, and Employers will not be able to contribute less than the set rate.

As an illustrative example, for someone earning €20,000 per year, the actual amounts are:

Benefits for Employers

There are huge benefits for an Employer with the introduction on Auto-Enrolment.

- Not having to pay to set up a company pension scheme.

- Not having to administer a company pension scheme.

- Ensuring that Employees are looked after.

- Increased competitiveness and attractiveness as an Employer.

- Employer contributions will be deductible for corporation tax purposes.

Updated recommendations to this Bill

Just last month the Joint Committee on Social Protection, Community and Rural Development and the Islands Committee with officials from the Department of Social Protection, The Pensions Authority, the ESRI, Irish Life, Insurance Ireland and Employer and Employee representative stakeholders held further talks on the pre-legislative scrutiny of the General Scheme of the Heads of Bill. They have put forward several recommendations, with the following points potentially most relevant to Employers.

- lower age limit to be reduced from 23 to 16 years, aligning it with the PRSI minimum age threshold.

- lower income threshold of €20,000 be removed as the threshold of €20,000 can penalise young workers, low earners, and disproportionately women.

- when participants are auto enrolled, they should be given a sample of the likely pension they will receive on retirement in real terms by adjusting for inflation.

- that Automatic-Enrolment be covered by a strong governance framework, incorporating annual evidence-based reviews.

- investment advice should be offered to all AE members to allow them to select the most appropriate fund for their age, gender, financial position, and circumstances.

- Clarity should be provided on the form of taxation to be applied to pension pots in retirement so that members can make proper provision for the future over the long term.

- The Department should carefully consider tax relief in the General Scheme of the Automatic Enrolment Bill and its impacts on the wider pension system.

This latest update for the Joint Committee implies that the Bill will need further modifications, however, the urgency to ensure that this is implemented in Q1 2024 is apparent. With less than 6 months to ensure you are prepared for these changes once introduced, it is important for Employers to familiarise themselves with the specific legal requirements and obligations outlined in the legislation.

If you require advice or guidance regarding the introduction, implementation, legal and compliance requirements of Auto-Enrolment Pensions, please contact any of the Adare Human Resource Management team at (01) 561 3594 or email info@adarehrm.ie for more information on how we can help and the supports available under our Partnership Programme.

Adare Human Resource Management is a team of expert-led Employment Law, Industrial Relations and best practice Human Resource Management consultants.